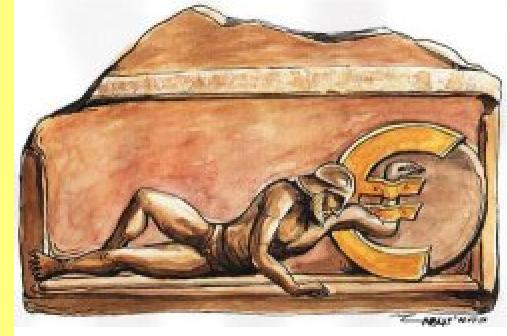

Contra la deuda ilegítima y la socialización del riesgo bancario

F. Fafatale / Madrid

El experto en deuda ilegítima Éric Toussaint, al 15M: "Necesitamos una revolución auténtica y el movimiento es solamente una primera etapa, pero fundamental y entusiasmante".

"Gracias a ellos [a los indignados del Estado español], después del movimiento en Túnez y Egipto, gracias también al movimiento en Grecia actual, estamos asistiendo a una aceleración de la historia". Quien pronuncia estas palabras es el politólogo Éric Toussaint, presidente de CADTM Bélgica, miembro del Consejo internacional del Foro social mundial y del Consejo Científico de ATTAC Francia, entre otras cosas. Toussaint lanzó este mensaje al 15M en una entrevista realizada durante la 2ª Universidad de Verano de CADTM que tuvo lugar a primeros de julio en Bélgica.

Due settimane dopo avere iniziato, il movimento greco degli ‘indignati’ riempie le piazze principali di tutte le città con tantissime persone che gridano la loro rabbia e fanno tremare il governo di Papandreu ed i suoi sostenitori locali ed internazionali.

Due settimane dopo avere iniziato, il movimento greco degli ‘indignati’ riempie le piazze principali di tutte le città con tantissime persone che gridano la loro rabbia e fanno tremare il governo di Papandreu ed i suoi sostenitori locali ed internazionali.

Este texto é o prólogo da edição grega do livro "Façamos o inquérito à dívida! – Manual para as auditorias da dívida do Terceiro Mundo" (Menons l'enquête sur la Dette ! – Manuel pour les audits de la dette du Tiers Monde). A edição grega é acrescida por um longo e importante texto de Maria Lucia Fattorelli sobre as experiências de auditoria da dívida pública do Equador e do Brasil, assim como do texto de Eric Toussaint intitulado "Alguns fundamentos jurídicos da anulação dívida".

Este texto é o prólogo da edição grega do livro "Façamos o inquérito à dívida! – Manual para as auditorias da dívida do Terceiro Mundo" (Menons l'enquête sur la Dette ! – Manuel pour les audits de la dette du Tiers Monde). A edição grega é acrescida por um longo e importante texto de Maria Lucia Fattorelli sobre as experiências de auditoria da dívida pública do Equador e do Brasil, assim como do texto de Eric Toussaint intitulado "Alguns fundamentos jurídicos da anulação dívida".