Secret IMF Documents on Greece commented by Eric Toussaint (CADTM)

by Eric Toussaint, International Monetary Fund (IMF)

The CADTM draws attention to two IMF documents dating from March and May 2010 that were kept secret. These authentic documents were placed at the disposal of the Truth Committee on Greek Public Debt by Zoe Konstantopoulou, the President of the Hellenic Parliament in office from 6 February to 3 October 2015.

The CADTM draws attention to two IMF documents dating from March and May 2010 that were kept secret. These authentic documents were placed at the disposal of the Truth Committee on Greek Public Debt by Zoe Konstantopoulou, the President of the Hellenic Parliament in office from 6 February to 3 October 2015.

"To persuade the IMF, the French, German and Dutch executive directors lied" Their contents are damning. They clearly show that a large number of IMF Executive Board members expressed severe criticism of the programme the Institution was preparing to implement. Some of them denounced the fact that the programme was aimed at rescuing the private European banks – mainly certain major French and German banks— who were creditors of Greek debt, both public and private. Several of them denounced the selfsame policies that had led to the Asian crisis of 1996-1997 and the Argentine crisis in 2001.

Several executives denounced the fact that the principal executive officers (mainly the Managing Director Dominique Strauss-Kahn and the Deputy Director John Lipsky) had, unbeknownst to the other members of the Board, modified one of the fundamental rules that condition credits allocated by the IMF to its members. Indeed, for a loan to be granted by the IMF, it must be shown that this loan and the accompanying programme will render debt repayment sustainable.

This condition could not be satisfied in the case of Greece, since the IMF directorate and the European authorities refused to reduce the Greek debt or to make private banks contribute.

Therefore the above-mentioned condition was deleted on the sly, and replaced by a new criterion: the need to avoid a high risk of international systemic financial destabilization. The IMF’s Management invoked urgency to justify this totally irregular change of the rules.

To persuade the IMF executives who were the most reticent, the French, German and Dutch directors lied, each promising that their country’s banks would not disengage from Greek bonds. They claimed that the French, German and Dutch banks would hold onto their Greek bonds to enable the newly-starting programme to succeed.

Since then it has been proven that the French, German and Dutch banks massively sold off the bonds they held on the secondary market, thus aggravating the Greek crisis and transferring to European tax-payers, especially Greek tax-payers, the burden of the risks they had taken and of the crisis which was largely their fault.

Again, to calm the reticence of certain executive directors, the IMF directors handling relations with Greece declared that social measures would be taken to protect people with low salaries and small pensions from the austerity measures. They lied. Furthermore, to get the agreement of the executive members of the IMF, they claimed that Greek banks were sound and that their problems were entirely due to risks engendered by far too much public debt and a colossal public deficit. This was untrue: Greek banks were in a disastrous situation.

Another lie invented to convince the doubters was that the plan would be submitted to the Hellenic Parliament for approval. In reality, the programme was forced upon the Parliament with no chance for amendment and with no regard for the Greek constitution, as numerous jurists pointed out at the time.

"Jean-Claude Trichet threatened to withdraw Greek banks' access to ECB liquidities" To the executive directors of the IMF who wanted the banks to contribute “collectively” to the solution by agreeing to debt reduction, those handling the Greek dossier pretended that the Greek authorities would not hear of public debt reduction. The Greek representative, Panagiotis Roumeliotis, confirmed this fabrication. Later, this same representative claimed that it was under pressure from the European Central Bank (ECB) that Greece had declared that it did not wish for debt reduction. According to Roumeliotis, Jean-Claude Trichet threatened to withdraw Greek banks’ access to ECB liquidities (see in French). Certainly, Jean-Claude Trichet did use this threat during the months of negotiation of the Memorandum. It turns out that he used the same threat against Ireland, too, a few months later during the fine-tuning of the Memorandum concerning that country. It is also known that Greek bankers, like the French, German and Dutch bankers, were not interested in Greek debt reduction as they refused to contribute to their own rescue package. The Greek bankers managed to get two years’ respite which enabled them to disengage and obtain significant compensation.

The IMF contended that as Greece belonged to the Eurozone, devaluing its currency to regain competitiveness was impossible so it would have to devalue wages and social benefits. This is what is known as internal devaluation, and it is wreaking havoc in Greece and other peripheral countries within the Eurozone.

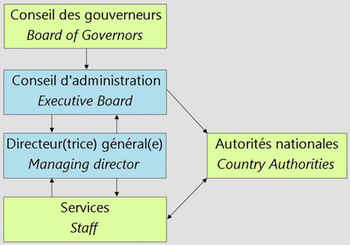

How the IMF works

Using the simplified organigram of the IMF below, Michel Husson explains how the IMF functions.

Source : FMI, Comment les décisions sont prises au FMI, Avril 2016

Source : FMI, Comment les décisions sont prises au FMI, Avril 2016

« A decision like the aid plan for Greece is made by the Executive Board on the basis of preliminary studies ordered from the relevant services by the Managing Director’s office. The IMF currently employs about 2,400 staff, half of whom are economists.

There are variable interactions or rather, fairly loose connections between the staff economists and general management which bear little resemblance to the larger body of economists on the IMF payroll. In some cases, when they are given a freer rein, they produce work which is almost heterodox. But for serious business, the conveyor belt goes into reverse and economists are expected to illustrate and defend the IMF’s political orientations. » |1|

Dans la traduction des documents du FMI ci-dessous, nous utilisons les termes de « directeurs exécutifs » pour désigner les membres du « conseil d’administration » (Executive Board) du FMI. Nous utilisons le terme « staff » pour désigner les « services » du FMI.

To start with, we invite you to read the report of the IMF Executive Board meeting held on 9 May 2010. It highlights the internal disagreements and is not written in the IMF’s usual bureaucratic waffle. As an official report, it is quite surprising. It certainly cannot have been appreciated by the principle directors of that despotic and deadly Institution. Reading it will enable you to form your own opinion.

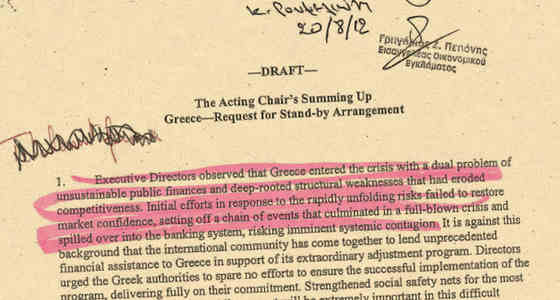

Première page du document - version annotée

May 10, 2010

STRICLY CONFIDENTIAL

Subject: Board meeting on Greece’s request for an SBA - May 9, 2010

The Board unanimously approved Greece’s request for a three-year Stand-By Arrangement (SBA) amounting to €30 billion (SDR 26.4 billion) or 32 times the Greek quota, the largest program approved by the Fund to date. Bilateral financial support of €80 billion will be available from euro area partners. The total amount of €110 billion will cover the expected public financing gap during the program’s period. Greece has undertaken to draw on the IMF and European Commission (EC) resources in a constant ratio of 3 to 8 in each disbursement throughout the program’s period.

The main objectives of the program are: (i) reducing the fiscal deficit to below 3 percent of GDP by 2014, with the debt-to-GDP ratio beginning to stabilize by 2013 and then declining gradually; (ii) safeguarding the stability of the financial system through the establishment of a fully independent Financial Stability Fund (FSF) that will support banks, if necessary; and (iii) restoring the competitiveness of the Greek economy through comprehensive structural reforms.

In addition to the fiscal measures already taken by the authorities in early 2010 (amounting to 5 percent of GDP), the program envisages a front loaded fiscal adjustment of 11 percent of GDP in 2010-13 . All the measures have been identified, the main ones being : (i) an increase of tax revenues by 4 percent of GDP, primarily through higher VAT rates; (ii) a significant reduction of expenditures by 5.2 percent of GDP, primarily through abolishing the 13th and 14th salaries of civil servants and the 13th and 14th pensions both in the public and private sectors, except for those with low salaries or pensions; and (iii) structural fiscal measures of 1.8 percent of GDP, which will.

While supporting the program, several non-European Executive Directors raised numerous criticisms.

1. Delay in requesting Fund assistance

According to some chairs (Australia, Canada, China, Russia, Switzerland), this delay highlighted shortcomings in the Euro Area architecture, including its .(rather confusing) communication strategy, which looked “piecemeal” according to the U.S. chair. The German ED clarified that, absent a provision in the Maastricht Treaty, the European Union had to rapidly devise a mechanism for financial assistance, which is now fully operational. It was most noticeable that six European EDs (Germany, Belgium, Spain, France, the Netherlands and Denmark) issued a joint statement in supporting the SBA for Greece.

2. Optimistic growth assumptions

The Chinese and Swiss chairs emphasized that growth will eventually determine the ability of Greece to manage its debt burden. Even a small departure from the program’s baseline scenario may derail the objective of fiscal consolidation, putting debt sustainability at risk. Staff replied that there can also be upside risks, possible related to the uncertain size of the informal economy.

3. Risks of the program.

Because of the double-digit fiscal adjustment faced by Greece, some EDs (Argentina, Australia, Canada, Brazil, and Russia) pointed to the “immense” risks of the program (and the ensuing reputational risk for the Fund). Some compared the Greek situation to that of Argentina before the end-2001 crisis. On the other side, the Russian ED noted that in the past other Fund programs (e.g., Brazil and Turkey) deemed particularly risky proved successful instead.

1st Box by the CADTM inserted in the text to facilitate understanding

Pablo Pereira, the Argentine representative, openly criticizes the past and present orientations of the IMF: “Argentina has been through a very long and sad history of Stand-By Agreements which were aimed at bailing out a debtor country but ended up rescuing private sector creditors, leaving behind massive capital flight and untenable social and economic consequences.

In Argentina, we know too well what the real consequences are of making believe that solvency crises are liquidity crises. Our own experience proves that bail-out packages or debt restructurings that disregard ‘debt sustainability’ and economic growth as a main feature of its design, leaving it to ‘future market access,’ are destined to be short lived.

We are also too familiar with the consequences of ‘structural reforms’ or policy adjustments that end up thoroughly curtailing aggregate demand and, thus, prospects of economic recovery. The so-called ‘structural reforms’ promoted by the Fund hurt deeply countries’ institutional quality and capacity. We have reviewed the projections of the staff, the recommendations and policy conditionalities. We do not share the views, for instance, that the widespread cuts in public expenditures, that a sharp decline in GDP, or that a major reduction in replacement rates of the pension system (from average 75 to 60 percent) will solve the Greek solvency problem. If anything, such measures risk to compound the problem.

An in-depth analysis of real repayment capacity should be the starting Argentina’s crisis: debt restructurings or bail-out packages should be crafted only after a country’s repayment capacity has been adequately assessed."

Source, p. 51

The exceptionally high risks of the program were recognized by staff itself, in particular in its assessment of debt sustainability, by stating that “on balance, staff considers debt to be sustainable over the medium term, but. the significant uncertainties around this make it difficult to state categorically that this is the case with a high probability”.

Staff stressed that the credibility of the program relies in part on the fact that it allows Greece not to not tap markets for a long period of time (1-2 years). Effective implementation of the program would lead to substantial fiscal primary surpluses that are expected to reassure markets despite the high level of public debt.

Staff admits that the program will not work if structural reforms are not implemented. In this regard, the biggest challenge for the authorities will be overcoming the fierce opposition of vested interests. The Australian ED emphasized the risk of repeating the mistakes made during the Asian crisis, in terms of imposing too much structural conditionality. While Fund’s structural conditionality is “macro-critical”, the conditionality imposed by European Commission seems a “shopping list”.

Staff acknowledges that the program will certainly test the Greek society. Staff met with the main opposition parties, nongovernmental organizations, and trade unions. In staffs view, the “striking thing” is that the private sector is fully behind the program, as it is seen as the tool to bring to an end several privileges in the public sector.

Extrait du document - page 3 - version annotée

4. Debt restructuring

Several chairs (Argentina, Brazil, India, Russia, and Switzerland) lamented that the program has a missing element: it should have included debt restructuring and Private Sector Involvement (PSI), to avoid, according to the Brazilian ED. “a bailout of Greece ’s private sector bondholders, mainly European financial institutions”. The Argentine ED was very critical at the program, as it seems to replicate the mistakes (i.e., unsustainable fiscal tightening) made in the run up to the Argentina’s crisis of 2001. Much to the “surprise” of other European EDs, the Swiss ED forcefully echoed the above concerns about lack of the debt restructuring in the program, and pointed to the need for resuming the discussions on a Sovereign Debt Restructuring Mechanism.

Staff pointed out that debt restructuring has been ruled out by the Greek authorities themselves. Although there were discussions on PSI, replicating the experience of the Bank Coordination (“Vienna”) Initiative was not possible, because Greek sovereign bonds are dispersed among an unspecified number of holders. Besides, Mr. Lipsky pointed out that 90 percent of these, bonds do not include Collective Actions Clauses, which would complicate a restructuring even further.

The Dutch, French, and German chairs conveyed to the Board the commitments of their commercial banks to support Greece and broadly maintain their exposures.

2nd Box by the CADTM inserted in the text to facilitate understanding:

Socialization of the losses of private banks is a shock therapy reminiscent of what happened in Latin America and Asia.

There follows an excerpt from the declaration of the Brazilian Executive Director concerning the absence of a restructuring process in the programme:

“As it stands, the program risks substituting private for official financing. In other and starker words, it may be seen not as a rescue of Greece, which will have to undergo a wrenching adjustment, but as a bail-out of Greece’s private debt holders, mainly European financial institutions.”

Source, p. 49

As for the Argentine Executive Director, he declared:

“Since this is still a global systemic crisis, the strategy of squeezing public financing and isolating the country blaming it for past fiscal indiscipline or lack of competitiveness will most likely fail. [...] A sound and equitable burden sharing of their costs would have been good for the reputational costs of the Fund (that it could be blamed for simply buying some time or ensuring that foreign banks will be paid in full over the next year before the inevitable happens) and it would have been even better for the Greek population and its growth prospects.”

Source: op. cit. p. 53 and p. 55

The German Director then replied:

“I can inform Directors that German banks (… ) basically want to maintain a certain exposure to the Greek banks, which means that they will not sell Greek bonds and they will maintain credit lines to Greece.”

Source: op. cit. - pp. 60-61

The French Director made a declaration of similar tenor:

“There was a meeting earlier in the week between the major French banks and my Minister, Ms. Lagarde. I would like to stress what was released at the end of this meeting, which is a statement in which these French banks commit to maintain their exposure to Greece over the lifetime of the program. [...] So, it is clear that the French banks, which are among the most exposed banks in Greece, are going to do their job.”

Source: op. cit. p. 68

Lastly, the Dutch Director declared:

“The Dutch banks, in consultation with our Minister of Finance, have had discussions and have publicly announced they will play their part in supporting the Greek government and the Greek banks.”

Source: op. cit. p. 71

In fact, as several executive directors of the IMF had suspected and as the Truth Committee on Greek Public Debt reported, the real intention behind the agreement was to give the strongest banks of the Euro Zone time to dispose of their Greek securities.

The graph below shows clearly that French, German, Dutch, Belgian, Austrian and Italian banks and more disengaged from Greek bonds through 2010 and 2011.

Exposure of foreign banks in Greece (in billions of euros)

Source: BRI, Consolidated Ultimate Risk Basis.

In another article we will show that it is the ECB that gave them direct aid to disengage from Greek bonds by protecting them against the losses that they would normally have had to face.

As a consequence of the creditors’ refusal to agree to marking down their Greek bonds, sovereign Greek debt rose from 299 to 355 billion euros between the end of 2009 and the end of 2011, an increase of 18.78 %. Throughout 2010-2013, an unprecedented recession was triggered by the policies dictated by the IMF and the rest of the Troika. Not one of the IMF forecasts about the improvement of Greece’s finances has ever proved correct. The results of the 2010 Memorandum completely discredit the IMF’s optimistic predictions.

5. Modalities on the joint IMF/EC/ECB reviews of the program.

Some Chairs (China, Egypt, and Switzerland) stressed the risk that joint reviews may reveals differences of judgments among the three involved institutions (IMF/EC/ECB). Staff specified that representatives of the three institutions will be “sitting at the same table at the same time”. The Fund is an independent institution and will carry out the reviews accordingly. In principle, if the EC does not agree on disbursing its share of financing, because of unmet conditionality by the Greek authorities, the Fund might retain its financing because of lack of financial assurances. But this appears to be only a theoretical possibility. In fact, the mission chief for Greece (Mr. Thomsen) emphasized that ”cooperation is off to a good start”, as during the discussions in Athens the ECB took the lead on financial sector issues, the European Commission on structural issues, and the Fund on fiscal issues. Cooperation is a strength of the program, and there are checks and balances.

6. IMF’s “preferred creditor” status

The U.S. chair (supported by Brazil and Switzerland) emphasized that, because of the preferred creditor status, the Fund’s loan will be senior to the bilateral loans from E.U. countries pooled by the European Commission. Staff confirmed that this is the case, because of the public good nature of Fund financing, and in accordance with Paris Club’s rules.

7. Criterion No. 2 for Exceptional Access to Fund resources

The Swiss ED (supported by Australia, Brazil, Iran) noted that staff had “silently” changed in the paper (i.e., without a prior approval by the Board) the criterion No, 2 of the exceptional access policy, by extending it to cases where there is a high risk of international systemic spillover effects. The General Counsel clarified that this was justified by the need to proceed expeditiously, on the assumption that the Board approval would take place through the Summing Up. The change in the access policy was necessary because Greece could not constitute an exception, as Fund policies have to be uniformity applicable to the whole membership.

Contributor: F. Spadafora

Second IMF document - march 25th, 2010

International Monetary Fund (IMF)

SECRET

Greece – Key Issues

[25 mars 2010]

Greece needs a multiyear adjustment program with large financial backstopping. It needs more time than provided under present SGP limits to adjust the fiscal balance, get the debt under control, and implement structural reforms to restore competitiveness. During this transition period, the financing needs will be large, the economy will be very sensitive to negative shocks and the stress for Greek society will be high as well. Capital markets need strong confidence that funding assurances are in place for the long duration of these efforts, otherwise interest rates for Greek bonds will not come down and make the debt dynamics quickly unsustainable. The challenge goes much beyond overcoming the short-term problems resulting from a bunching of amortization payments in April-May of this year.

The economy is uncompetitive. Few reforms have been implemented, the economy remains relatively closed, and competitiveness has dropped by some 25 percent since euro adoption as domestic prices have continuously exceeded the euro average. The current account balance, even in the recession, still stands at 11 percent of GDP.

Fiscal policy has been poor. Reflecting higher spending on wages and entitlements, and tax cuts, non-interest spending jumped by 8 percent of GDP between 2000-09 and revenue fell by 3 percentage points, thus worsening the primary fiscal balance by 11 percent of GDP since 2000. Public debt increased to 115 percent of GDP.

Deflation and low growth will make this debt burden difficult to manage. With no recourse to exchange rate changes, Greece faces the dual challenge of restoring competitiveness through internal devaluation—always a long and arduous process— while undertaking a large fiscal adjustment. This will compel Greece to go through a period of nominal wage and benefit cuts—a disinflation scenario under which it will likely see several years of declining nominal GDP. Domestic spending, the base for fiscal revenues, is bound to be weak. Thus, deficits and debt relative to GDP will be under upward pressure even with significant fiscal adjustment: despite ambitious measures yielding 4 percent of GDP this year, the deficit is set to rise to 11½ % percent of GDP next year. Strong and prolonged fiscal adjustment is needed to break and reverse the upward trend in the debt ratio under the conditions facing Greece.

But the fiscal adjustment also needs to be realistic. Even with additional fiscal measures of 2-214 percent of GDP each year for some 5 years, debt to GDP would rise to about 150 percent of GDP by 2013, before stabilizing and beginning to slowly decline. Much faster adjustment—as implied by the SGP deficit target of 3 percent of GDP by 2012—will be very risky: Greece is a relatively closed economy, and the fiscal contraction implied by this adjustment path will cause a sharp contraction in domestic demand and an attendant deep recession, severely stretching the social fabric. This is also unlikely to be technically feasible as durable spending cuts require reforms and changes in entitlement program that will take time to implement and yield results.

The banking system poses an important further risk. With the downgrading of the sovereign, banks have come under funding pressures, been cut off from interbank credit lines and wholesale funding, and—recently-—lost deposits. Banks are using recourse to the ECB to tie themselves over, but this is not a durable solution. Moreover, the long downturn that lies ahead will significantly increase nonperforming loans, and it is possible, even likely, that the government will have to provide capital injections to stabilize the banking system and safeguard deposits. This would add further to the Government’s already large financing requirements.

Financing needs to remain big. Because deficit reduction takes time while amortizations on the growing stock of debt roll in, the public sector gross borrowing need will average about €50 billion in 2010-12, even with fiscal measures of 2-2½ percent of GDP every year, as discussed above. And this does not make allowance for the potential need for public support of the banking system,

Therefore, capital markets are scared. Financial markets look ahead and perceive the difficult period that is beginning to unfold. The continuous rise in the debt ratio threatens sovereign ratings and pushes up spreads on Greek bonds. Markets need to be assured that a default is off the table before committing more funds.

Footnotes

|1| Michel Husson, Grèce : les « erreurs » du FMI (Greece: the ‘errors’ of the IMF), 2 september 2016. Quote translated by the CADTM.